Blu-ray and DVD sales - We're number 2, but we try harder

#5377

DVD Talk Special Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

Updated thru week ending 12/29/18

Table of Blu-ray sales (HMM and DEG)

numbers are in (revenue) millions.

Weekly figures are from HMM (Home Media Magazine)

Table of Blu-ray sales (HMM and DEG)

numbers are in (revenue) millions.

Weekly figures are from HMM (Home Media Magazine)

Code:

Week Date OD OD YoY DVD DVD YoY BD BD YoY BD Share TBO2018 TBO2017 2018 MPN 4108.60 -12.9% 2245.69 -20.7% 1862.99 -1.2% 45.3% 12132.1 10520.1 Q4 MPN 1262.03 -11.7% 684.77 -21.9% 577.28 4.6% 45.7% 3147.9 2504.6 52 12/29 90.76 11.5% 48.12 -4.2% 42.64 36.8% 47.0 % 24.1 49.6 51 12/22 163.61 -16.8% 84.22 -29.9% 79.39 3.9% 48.5 % 396.6 293.4 50 12/15 117.07 -20.7% 65.94 -27.8% 51.13 9.3% 43.7 % 260.2 154.9 49 12/8 98.15 -17.4% 55.78 -25.7% 42.37 -3.2% 43.2 % 386.6 303.9 48 12/1 104.65 -17.5% 57.80 -26.6% 46.85 -2.6% 44.8 % 26.7 31.3 47 11/24 220.82 -9.1% 116.45 -20.8% 104.37 8.9% 47.3 % 194.0 153.6 46 11/17 71.95 -0.8% 39.82 -15.4% 32.13 26.1% 44.7 % 221.4 117.7 45 11/10 79.76 -1.1% 38.41 -18.4% 41.36 23.1% 51.8 % 760.6 181.1 44 11/3 61.85 -10.7% 34.18 -24.6% 27.67 15.7% 44.7 % 114.0 81.6 43 10/27 57.62 -20.1% 33.58 -24.6% 24.04 -12.9% 41.7 % 138.2 340.1 42 10/20 68.98 -11.3% 37.29 -14.6% 31.69 -7.0% 45.9 % 230.3 452.7 41 10/13 66.10 -1.4% 37.85 -9.5% 28.26 22.4% 42.7 % 256.7 164.6 40 10/6 60.71 -21.3% 35.33 -20.5% 25.38 -22.4% 41.8 % 138.7 180.2 Q3 MPN 866.37 -11.1% 459.31 -20.6% 407.08 2.8% 47.0% 2982.6 2487.8 39 9/29 71.25 -4.1% 35.70 -16.7% 35.55 13.2% 49.9 % 261.9 176.3 38 9/22 69.33 -21.8% 36.66 -19.4% 32.67 -24.4% 47.1 % 417.2 461.0 37 9/15 53.02 -20.8% 32.71 -22.3% 20.31 -18.3% 38.3 % 160.3 176.9 36 9/8 57.96 -13.5% 34.43 -19.7% 23.53 -2.4% 40.6 % 99.1 94.6 35 9/1 64.90 -15.9% 36.03 -18.9% 28.87 -11.9% 44.5 % 152.1 74.9 34 8/25 82.04 -8.8% 37.00 -17.5% 45.05 0.2% 54.9 % 350.5 389.8 33 8/18 93.35 34.5% 38.37 -12.8% 54.99 116.4% 58.9 % 682.7 157.8 32 8/11 57.57 -12.3% 31.25 -27.4% 26.32 16.6% 45.7 % 102.9 109.0 31 8/4 59.94 -12.8% 34.73 -22.2% 25.21 4.7% 42.1 % 70.6 79.3 30 7/28 62.39 -17.5% 33.19 -26.5% 29.20 -4.2% 46.8 % 138.8 252.3 29 7/21 78.20 0.2% 39.76 -13.8% 38.44 20.5% 49.2 % 266.6 178.7 28 7/14 56.80 -35.5% 33.77 -32.0% 23.03 -40.1% 40.5 % 209.8 289.2 27 7/7 59.62 -8.3% 35.71 -17.7% 23.91 10.4% 40.1 % 70.2 18.0 Q2 MPN 891.42 -20.6% 489.53 -23.1% 401.90 -17.2% 45.1% 2420.5 3048.0 26 6/30 59.30 -17.2% 35.52 -21.0% 23.78 -10.7% 40.1 % 44.3 117.6 25 6/23 65.01 -14.7% 36.87 -21.5% 28.13 -3.8% 43.3 % 102.6 33.4 24 6/16 75.55 -28.3% 40.59 -26.3% 34.97 -30.5% 46.3 % 250.1 276.2 23 6/9 62.28 -42.6% 33.59 -35.7% 28.70 -49.0% 46.1 % 155.3 521.3 22 6/2 58.48 -19.5% 33.78 -25.2% 24.71 -10.0% 42.2 % 32.7 106.2 21 5/26 65.17 -19.9% 34.80 -21.8% 30.37 -17.5% 46.6 % 164.2 457.7 20 5/19 92.29 36.4% 41.58 0.9% 50.71 91.8% 54.9 % 703.7 79.7 19 5/12 70.17 -8.5% 38.37 -18.3% 31.80 7.0% 45.3 % 103.7 115.1 18 5/5 66.66 -6.5% 37.99 -16.9% 28.67 12.0% 43.0 % 190.2 114.5 17 4/28 61.67 -17.5% 35.19 -20.2% 26.47 -13.6% 42.9 % 191.6 181.6 16 4/21 63.67 -10.2% 37.29 -14.1% 26.39 -4.0% 41.4 % 120.5 171.9 15 4/14 78.87 -33.0% 42.39 -36.4% 36.47 -28.5% 46.2 % 273.2 283.3 14 4/7 72.30 -43.3% 41.57 -30.4% 30.73 -54.6% 42.5 % 88.4 589.6 Q1 MPN 1088.78 -8.7% 612.08 -17.2% 476.73 5.2% 43.8% 3581.1 2509.6 13 3/31 138.87 22.9% 63.50 4.8% 75.37 43.8% 54.3 % 620.3 344.2 12 3/24 105.79 2.6% 56.99 -4.5% 48.81 12.3% 46.1 % 532.4 340.7 11 3/17 113.04 14.9% 54.97 -11.8% 58.07 61.2% 51.4 % 445.2 191.4 10 3/10 111.47 -8.4% 54.01 -20.0% 57.46 6.1% 51.5 % 373.0 268.5 9 3/3 102.82 -4.7% 55.08 -13.7% 47.74 8.4% 46.4 % 434.6 311.2 8 2/24 73.91 -20.6% 48.85 -21.2% 25.06 -19.4% 33.9 % 158.4 143.5 7 2/17 70.73 -20.9% 45.34 -22.0% 25.40 -18.7% 32.7 % 51.8 159.2 6 2/10 61.97 -33.1% 40.53 -31.0% 21.44 -36.8% 34.6 % 102.0 210.8 5 2/3 56.29 -28.2% 37.88 -26.7% 18.41 -31.2% 32.7 % 51.8 159.2 4 1/27 58.95 -19.3% 35.92 -24.6% 23.04 -9.2% 39.1 % 86.0 52.0 3 1/20 64.03 -7.6% 37.97 -18.1% 26.06 13.5% 40.7 % 161.2 127.6 2 1/13 68.98 -8.8% 41.08 -16.2% 27.90 4.7% 40.4 % 398.5 191.3 1 1/6 61.93 -19.8% 39.96 -23.4% 21.97 -12.4% 35.5 % 71.1 45.6 2017 HMM 4709.40 -13.4% 2821.76 -17.3% 1887.65 -6.8% 40.1% 10508.2 11900.9 Q4 HMM 1423.53 -22.4% 867.51 -23.1% 556.04 -21.3% 39.1% 2496.8 3568.0 52 12/30 81.24 -13.3% 49.95 -15.0% 31.29 -10.3% 38.5 % 49.6 69.1 51 12/23 193.26 -31.2% 117.63 -31.0% 75.63 -31.5% 39.1 % 292.0 299.4 50 12/16 147.11 -32.3% 90.63 -28.4% 56.48 -37.8% 38.4 % 154.9 502.9 49 12/9 118.29 -33.8% 74.56 -30.4% 43.73 -38.8% 37.0 % 303.9 539.1 48 12/2 126.21 -21.2% 78.17 -21.3% 48.04 -21.0% 38.1 % 31.3 233.8 47 11/25 242.10 -13.0% 144.88 -15.7% 97.22 -8.5% 40.2 % 149.9 144.0 46 11/18 72.18 -37.2% 46.53 -27.9% 25.65 -49.1% 35.5 % 117.6 486.6 45 11/11 80.34 -2.3% 46.46 -16.1% 33.89 26.1% 42.2 % 181.1 101.2 44 11/4 68.91 -25.2% 44.56 -22.1% 24.35 -30.3% 35.3 % 81.6 295.6 43 10/28 72.23 0.5% 44.57 -11.7% 27.66 29.1% 38.3 % 339.8 113.9 42 10/21 77.71 -8.9% 43.48 -20.9% 34.23 12.7% 44.0 % 452.3 194.5 41 10/14 66.95 -27.0% 41.76 -27.4% 25.19 -26.4% 37.6 % 164.5 347.7 40 10/7 77.00 -11.6% 44.33 -16.7% 32.68 -3.6% 42.4 % 178.4 240.3 Q3 HMM 971.84 -8.5% 577.81 -15.1% 394.04 3.1% 40.5% 2461.3 2480.5 39 9/30 74.02 -10.5% 42.68 -15.5% 31.35 -2.7% 42.3 % 176.3 286.2 38 9/23 88.62 0.2% 45.32 -11.5% 43.29 16.2% 48.9 % 460.6 158.5 37 9/16 66.52 -34.1% 41.87 -25.9% 24.66 -44.5% 37.1 % 176.7 521.6 36 9/9 66.99 -16.8% 42.78 -21.2% 23.92 -7.6% 35.9 % 94.5 141.9 35 9/2 76.77 -11.5% 44.34 -21.4% 32.43 6.9% 42.2 % 74.9 420.6 34 8/26 89.64 19.2% 44.75 -13.5% 44.89 91.3% 50.1 % 389.7 102.5 33 8/19 69.55 -3.2% 43.98 -12.1% 25.57 17.3% 36.8 % 157.8 128.5 32 8/12 65.32 -0.7% 43.11 -10.1% 22.21 24.4% 34.0 % 108.9 4.2 31 8/5 68.55 -9.0% 44.70 -13.4% 23.85 0.5% 34.8 % 79.3 78.9 30 7/29 75.57 -2.3% 45.15 -10.5% 30.42 13.1% 40.3 % 252.1 145.4 29 7/22 77.90 -19.5% 46.10 -13.2% 31.79 -27.2% 40.8 % 183.8 345.7 28 7/15 87.91 2.1% 49.66 -10.9% 38.25 25.9% 43.5 % 288.9 140.2 27 7/8 64.78 -13.7% 43.37 -14.9% 21.41 -11.3% 33.1 % 17.9 6.4 Q2 HMM 1121.50 -4.9% 637.12 -10.1% 484.35 2.9% 43.2% 3044.2 2989.7 26 7/1 71.44 -9.1% 44.95 -16.4% 26.49 6.7% 37.1 % 117.6 185.8 25 6/24 76.11 -0.6% 46.93 -9.9% 29.18 19.3% 38.3 % 33.4 72.4 24 6/17 105.28 7.5% 55.01 -10.2% 50.27 37.0% 47.7 % 276.5 175.6 23 6/10 108.48 1.2% 52.23 -13.6% 56.26 20.4% 51.9 % 520.6 434.0 22 6/3 72.52 4.1% 45.41 -11.5% 27.10 11.7% 37.4 % 106.2 74.0 21 5/27 81.33 -11.5% 44.57 -9.5% 36.75 55.2% 45.2 % 456.6 140.1 20 5/20 67.70 -11.9% 41.29 -17.0% 26.41 -2.6% 39.0 % 79.7 61.1 19 5/13 76.67 -28.1% 47.03 -16.6% 29.64 -41.0% 38.7 % 115.0 403.7 18 5/6 71.29 -11.5% 45.76 -16.3% 25.33 -1.5% 35.8 % 114.3 112.8 17 4/29 74.86 -3.5% 44.17 -14.1% 30.68 17.4% 41.0 % 181.6 140.5 16 4/22 70.83 -15.1% 43.41 -16.9% 27.41 -12.2% 38.7 % 171.8 225.2 15 4/15 117.63 32.1% 66.62 26.7% 51.01 40.9% 43.4 % 281.6 26.6 14 4/8 127.36 -18.9% 59.74 -6.2% 67.62 -27.6% 53.1 % 589.4 938.0 Q1 HMM 1192.53 -12.3% 739.32 -17.4% 453.22 -2.5% 38.0% 2505.9 2862.7 13 4/1 112.95 24.4% 60.55 -0.2% 52.40 73.8% 46.4 % 344.2 118.2 12 3/25 103.13 -28.7% 59.67 -35.5% 43.46 -16.7% 42.1 % 340.2 433.9 11 3/18 98.33 -12.1% 62.34 -17.5% 35.99 -0.9% 36.6 % 191.2 295.0 10 3/11 121.64 23.2% 67.49 -0.4% 54.15 74.6% 44.5 % 267.7 162.7 9 3/4 107.76 6.5% 63.76 -7.5% 44.00 36.5% 40.8 % 310.3 184.5 8 2/25 93.03 -12.0% 61.94 -12.3% 31.09 -11.3% 33.4 % 143.1 190.7 7 2/18 89.28 -8.3% 58.05 -14.9% 31.23 7.3% 35.0 % 123.5 101.2 6 2/11 92.58 -23.3% 58.63 -25.2% 33.95 -19.8% 36.7 % 210.1 266.0 5 2/4 78.85 -22.1% 51.94 -20.0% 26.91 -25.8% 34.1 % 159.2 123.2 4 1/28 72.94 -25.9% 47.60 -27.1% 25.34 -23.5% 34.7 % 52.1 97.3 3 1/21 69.27 -31.1% 46.31 -26.5% 22.97 -38.9% 33.2 % 127.6 302.3 2 1/14 75.60 -24.5% 48.94 -19.9% 26.66 -31.6% 35.3 % 191.3 449.5 1 1/7 77.17 -12.5% 52.10 -9.6% 25.07 -18.0% 32.5 % 45.6 138.3 2016 HMM 5453.79 -9.0% 3430.39 -13.5% 2023.41 -0.5% 37.1% 11887.0 10533.0 Q4 HMM 1846.85 -13.1% 1136.34 -13.3% 710.53 -12.9% 38.5% 3565.4 3309.2 52 12/31 94.19 -23.2% 59.19 -22.3% 35.01 -24.7% 37.2 % 69.0 109.1 51 12/24 282.55 1.6% 171.74 1.2% 110.81 2.1% 39.2 % 298.5 105.5 50 12/17 218.73 -17.6% 127.64 -19.2% 91.09 -15.3% 41.6 % 502.4 417.4 49 12/10 179.82 -17.0% 108.07 -14.0% 71.75 -21.2% 39.9 % 538.7 532.3 48 12/3 161.58 -3.7% 100.45 -8.4% 61.13 5.1% 37.8 % 233.7 19.6 47 11/2 280.33 -4.3% 173.78 -9.5% 106.55 5.5% 38.0 % 144.0 87.9 46 11/19 116.00 13.5% 65.09 -3.3% 50.91 45.8% 43.9 % 486.6 52.6 45 11/12 82.80 -24.8% 55.69 -20.7% 27.11 -31.9% 32.7 % 101.2 230.8 44 11/5 92.68 -27.5% 57.51 -25.7% 35.18 -30.3% 38.0 % 295.6 420.1 43 10/29 72.35 -29.5% 50.73 -22.6% 21.62 -41.6% 29.9 % 113.6 217.9 42 10/22 85.81 -35.3% 55.20 -19.1% 30.61 -52.4% 35.7 % 194.6 697.4 41 10/15 92.22 -13.7% 57.73 -9.6% 34.49 -19.8% 37.4 % 347.6 290.2 40 10/8 87.79 -11.6% 53.52 -19.2% 34.27 3.8% 39.0 % 240.2 128.4 Q3 HMM 1062.92 -7.8% 680.69 -14.7% 382.21 7.6% 36.0% 2480.1 2303.8 39 10/1 83.38 -28.0% 50.61 -29.4% 32.77 -25.8% 39.3 % 286.0 650.0 38 9/24 88.47 -6.9% 50.51 -18.8% 37.95 15.6% 42.9 % 158.3 185.3 37 9/17 100.88 -18.7% 56.65 -18.7% 44.22 -12.9% 43.8 % 521.4 584.4 36 9/10 80.07 0.1% 54.37 -7.1% 25.70 19.6% 32.1 % 141.9 43.9 35 9/3 86.79 -2.0% 56.56 -7.8% 30.23 11.0% 34.8 % 420.5 163.8 34 8/27 75.45 3.0% 51.95 -5.7% 23.50 29.4% 31.1 % 103.0 27.9 33 8/20 71.78 -5.7% 50.09 -12.0% 21.69 13.2% 30.2 % 128.5 7.8 32 8/13 65.55 -16.8% 47.80 -18.8% 17.75 -10.8% 27.1 % 4.2 67.2 31 8/6 75.00 -18.8% 51.34 -20.4% 23.66 -15.1% 31.5 % 78.9 166.8 30 7/30 77.19 -11.2% 50.45 -16.7% 26.74 1.3% 34.6 % 145.1 182.1 29 7/23 96.62 25.8% 53.10 -5.4% 43.52 110.3% 45.0 % 345.7 3.7 28 7/16 85.82 -6.5% 55.62 -12.8% 30.20 8.0% 35.2 % 140.2 185.9 27 7/9 75.92 -1.5% 51.64 -11.5% 24.28 29.7% 32.0 % 6.4 35.1 Q2 HMM 1188.41 4.3% 716.43 -9.5% 471.98 35.9% 39.7% 2985.4 1764.1 26 7/2 79.30 -1.7% 54.21 -10.4% 25.08 24.6% 31.6 % 185.8 115.1 25 6/25 77.13 0.6% 52.63 -6.9% 24.50 21.5% 31.8 % 72.4 0.1 24 6/18 98.65 1.9% 61.90 -4.9% 36.75 15.7% 37.3 % 175.5 100.5 23 6/11 107.74 19.3% 60.99 -1.2% 46.75 63.7% 43.4 % 431.8 185.5 22 6/4 76.29 -22.2% 51.94 -20.9% 24.35 -24.7% 31.9 % 73.8 309.0 21 5/28 73.60 -12.0% 49.82 -14.9% 23.78 -5.1% 32.3 % 140.1 23.6 20 5/21 77.54 -26.5% 50.34 -25.8% 27.20 -27.9% 35.1 % 61.1 376.0 19 5/14 107.18 23.1% 56.93 -6.0% 50.25 89.4% 46.9 % 403.3 34.5 18 5/7 81.33 -19.5% 55.32 -17.3% 26.02 -23.7% 32.0 % 112.7 251.6 17 4/30 78.19 -1.6% 52.00 -9.3% 26.19 18.3% 33.5 % 140.1 23.6 16 4/23 84.07 4.5% 52.84 -8.3% 31.23 37.0% 37.1 % 224.9 91.7 15 4/16 89.59 17.2% 53.25 -2.1% 36.34 64.8% 40.6 % 26.6 43.1 14 4/9 157.80 90.2% 64.26 9.0% 93.54 289.4% 59.3 % 937.2 7.8 Q1 HMM 1355.61 -14.1% 896.93 -15.7% 458.69 -10.9% 33.8% 2856.1 3156.0 13 4/2 91.71 -39.0% 61.35 -38.2% 30.35 -40.5% 33.1 % 118.1 333.7 12 3/26 145.35 0.1% 93.05 2.4% 52.30 -3.8% 36.0 % 433.8 498.8 11 3/19 112.95 0.7% 76.44 -0.2% 36.52 2.7% 32.3 % 294.4 260.6 10 3/12 99.52 -16.8% 68.43 -15.6% 31.08 -19.3% 31.2 % 162.6 114.5 9 3/5 86.02 -38.5% 60.05 -34.3% 25.97 -46.3% 30.2 % 184.1 350.9 8 2/27 106.70 -29.5% 71.62 -24.7% 35.08 -37.7% 32.9 % 186.8 303.2 7 2/20 98.44 -18.9% 69.29 -15.6% 29.15 -25.9% 29.6 % 101.2 218.7 6 2/13 122.01 -5.6% 79.65 -12.7% 42.36 11.3% 34.7 % 265.7 126.4 5 2/6 102.48 -15.3% 66.32 -21.2% 36.17 -1.7% 35.3 % 123.0 182.6 4 1/30 99.47 -10.2% 66.32 -11.6% 33.15 -7.1% 33.3 % 97.3 192.7 3 1/23 101.43 1.1% 63.96 -7.1% 37.47 19.2% 36.9 % 302.3 273.7 2 1/16 100.71 12.1% 62.20 -4.4% 38.52 55.4% 38.2 % 448.4 201.4 1 1/9 88.82 0.9% 58.25 -8.5% 30.57 25.4% 34.4 % 138.3 98.7 2015 HMM 5982.0 -11.6% 3959.60 -14.9% 2022.43 -4.6% 33.8% 10548.9 10507.6 Q4 HMM 2120.41 -6.6% 1312.11 -14.9% 808.32 11.2% 38.1% 3308.0 3199.3 52 1/2 122.55 1.1% 76.23 -9.2% 46.32 24.1% 37.8 % 109.1 103.7 51 12/26 278.08 5.8% 170.80 -6.4% 107.28 33.3% 38.6 % 105.5 7.1 50 12/19 265.13 -13.5% 159.63 -22.9% 105.50 5.9% 39.8 % 417.3 343.8 49 12/12 215.99 -13.0% 128.33 -20.5% 87.66 1.0% 40.6 % 532.3 410.0 48 12/5 167.01 -17.8% 108.97 -21.9% 58.04 -8.9% 34.8 % 19.5 291.0 47 11/28 292.88 -11.2% 191.68 -15.3% 101.20 -2.3% 34.6 % 87.9 165.5 46 11/21 101.56 -21.3% 66.89 -26.6% 34.68 -8.4% 34.1 % 52.6 324.7 45 11/14 109.57 -20.8% 69.83 -22.8% 39.74 -17.1% 36.3 % 230.6 391.6 44 11/7 127.41 -1.2% 77.03 -7.4% 50.38 10.2% 39.5 % 419.7 408.6 43 10/31 101.99 14.7% 65.10 -2.2% 36.90 65.0% 36.2 % 217.9 65.1 42 10/24 132.34 41.4% 68.00 1.9% 64.34 139.6% 48.6 % 697.0 157.5 41 10/17 106.67 -5.0% 63.65 -12.6% 43.02 9.2% 40.3 % 290.2 347.5 40 10/10 99.23 -6.7% 65.97 -7.0% 33.26 -6.2% 33.5 % 128.4 183.4 Q3 HMM 1147.35 -13.2% 793.83 -15.3% 353.52 -8.1% 30.8% 2299.4 2295.6 39 10/3 115.56 1.4% 71.34 -3.4% 44.22 10.3% 38.3 % 650.1 278.5 38 9/26 94.73 -2.5% 61.87 -11.4% 32.86 20.1% 34.7 % 184.7 156.0 37 9/19 120.04 -0.2% 69.38 -14.0% 50.66 28.0% 42.2 % 582.4 391.7 36 9/12 79.80 -28.5% 58.35 -20.4% 21.45 -44.0% 26.9 % 43.9 285.5 35 9/5 88.23 -0.7% 61.12 -10.2% 27.11 30.7% 30.7 % 163.6 40.0 34 8/29 73.03 -25.3% 54.90 -23.7% 18.12 -29.9% 24.8 % 27.8 66.3 33 8/22 75.79 -26.7% 56.68 -20.0% 19.12 -41.2% 25.2 % 7.8 217.1 32 8/15 78.42 -21.4% 58.56 -19.0% 19.85 -27.6% 25.3 % 67.1 93.1 31 8/8 92.02 -17.7% 64.19 -18.5% 27.83 -15.9% 30.2 % 166.8 283.1 30 8/1 86.59 -14.0% 60.24 -17.8% 26.35 -3.9% 30.4 % 181.8 187.2 29 7/25 76.44 -23.6% 55.78 -24.6% 20.66 -20.7% 27.0 % 3.7 147.7 28 7/18 91.34 -5.5% 63.42 -9.0% 27.93 3.6% 30.6 % 184.7 134.7 27 7/11 75.36 -5.9% 58.00 -4.7% 17.36 -9.7% 23.0 % 34.9 14.6 Q2 HMM 1136.2 -17.9% 789.33 -18.0% 346.83 -17.5% 30.5% 1763.1 1836.5 26 7/4 80.04 -10.1% 59.99 -9.6% 20.05 -11.6% 25.0 % 115.1 4.7 25 6/27 76.22 -21.3% 56.18 -16.9% 20.04 -31.5% 26.3 % 0.1 121.6 24 6/20 96.47 -18.9% 64.82 -15.8% 31.65 -24.5% 32.8 % 100.5 317.6 23 6/13 90.01 -21.9% 61.54 -19.8% 28.47 -26.0% 31.6 % 185.5 145.4 22 6/6 97.72 -12.0% 65.23 -11.7% 32.49 -12.6% 33.2 % 308.9 243.4 21 5/30 83.37 0.7% 58.42 -3.7% 24.95 12.7% 29.9 % 23.6 23.6 20 5/23 105.56 18.2% 67.81 6.1% 37.74 48.8% 35.8 % 375.9 189.1 19 5/16 86.81 2.2% 60.42 -2.7% 26.39 15.3% 30.4 % 34.3 72.1 18 5/9 100.88 10.2% 66.77 -0.7% 34.11 40.2% 33.8 % 251.6 5.7 17 5/2 79.35 -10.8% 57.24 -12.2% 22.11 -6.8% 27.9 % 225.1 51.6 16 4/25 80.42 -10.4% 57.62 -11.9% 22.80 -6.5% 28.4 % 91.6 0.1 15 4/18 76.44 -56.7% 54.38 -55.8% 22.06 -58.7% 28.9 % 43.1 296.7 14 4/11 82.89 -44.1% 58.91 -37.0% 23.97 -56.2% 28.9 % 7.8 365.0 Q1 HMM 1578.06 -12.1% 1064.33 -11.9% 513.76 -12.4% 32.6% 3178.4 3176.1 13 4/4 150.33 10.2% 99.28 9.4% 51.05 11.8% 34.0 % 332.0 165.9 12 3/28 145.19 -3.0% 90.83 -9.0% 54.36 9.1% 37.4 % 498.8 187.9 11 3/21 112.10 -53.7% 76.52 -45.3% 35.58 -65.1% 31.7 % 260.4 643.5 10 3/14 119.66 -11.6% 81.16 -13.1% 38.50 -8.3% 32.2 % 113.4 66.6 9 3/7 139.83 -1.7% 91.54 -14.1% 48.29 -18.6% 34.5 % 350.9 490.2 8 2/28 151.40 -2.6% 95.11 -3.3% 56.32 -1.4% 37.2 % 303.3 506.5 7 2/21 120.65 -5.2% 82.04 -7.6% 38.61 0.3% 32.0 % 216.5 0.2 6 2/14 129.22 -17.1% 91.16 -18.0% 38.06 -12.9% 29.5 % 126.3 162.8 5 2/7 120.93 3.2% 84.14 -0.7% 36.79 13.4% 30.4 % 184.4 147.1 4 1/31 110.66 0.4% 75.00 -3.0% 35.67 8.3% 32.2 % 192.8 319.5 3 1/24 100.24 4.2% 68.82 -1.4% 31.43 18.8% 31.4 % 273.7 196.0 2 1/17 89.84 -15.3% 65.07 -14.6% 24.76 -17.2% 27.6 % 201.2 261.7 1 1/10 87.99 -10.9% 63.66 -11.4% 24.34 -9.5% 27.7 % 124.8 28.2 2014 HMM 6783.24 -10.1% 4661.69 -11.0% 2121.58 -7.9% 31.3% 10450.6 10589.2 Q4 HMM 2267.71 -14.1% 1540.94 -13.0% 726.79 -16.4% 32.0% 3157.4 3445.0 52 1/3 121.21 -4.4% 83.90 -6.1% 37.31 -0.5% 30.8 % 103.7 24.5 51 12/27 263.04 -3.6% 182.27 -3.0% 80.77 -4.8% 30.7 % 7.1 83.9 50 12/20 306.48 -20.8% 206.91 -21.0% 99.57 -20.5% 32.5 % 343.4 406.9 49 12/13 248.11 -24.8% 161.33 -20.5% 86.78 -31.7% 35.0 % 409.4 618.1 48 12/6 203.22 -11.9% 139.51 -8.0% 63.71 -19.3% 31.4 % 291.0 235.1 47 11/29 329.76 -11.5% 226.35 -10.7% 103.42 -13.4% 31.4 % 165.5 80.0 46 11/22 128.77 -17.6% 90.97 -14.0% 37.81 -25.2% 29.4 % 324.7 354.1 45 11/15 138.26 -8.0% 90.36 -4.8% 47.90 -13.5% 34.6 % 391.5 380.3 44 11/8 128.78 2.9% 83.10 -5.6% 45.68 22.9% 35.5 % 408.5 209.3 43 11/1 88.60 -31.4% 66.32 -24.2% 22.28 -46.6% 25.1 % 65.1 302.2 42 10/25 93.20 -14.2% 66.38 -15.6% 26.82 -10.5% 28.8 % 157.1 212.5 41 10/18 112.00 -14.9% 72.69 -17.5% 39.31 -9.5% 35.1 % 347.4 293.7 40 10/11 106.28 -10.8% 70.85 -12.9% 35.43 -6.1% 33.3 % 182.9 244.6 Q3 HMM 1320.38 -8.6% 935.73 -8.5% 384.66 -9.1% 29.1% 2295.1 2305.5 39 10/4 113.89 -18.5% 73.80 -12.6% 40.09 -27.5% 35.2 % 278.5 288.6 38 9/27 97.15 -22.7% 69.79 -11.9% 27.37 -41.1% 28.2 % 155.7 414.8 37 9/20 120.20 5.5% 80.61 2.8% 39.59 11.5% 32.9 % 391.2 213.6 36 9/13 111.46 -16.0% 73.15 -14.5% 38.31 -18.7% 34.4 % 285.5 239.8 35 9/6 88.74 -18.9% 68.01 -17.8% 20.73 -22.1% 23.4 % 40.0 123.9 34 8/30 97.67 -16.3% 71.81 -15.8% 25.85 -17.5% 26.5 % 67.6 197.5 33 8/23 103.27 0.9% 70.74 -7.8% 32.53 27.1% 31.5 % 217.1 146.6 32 8/16 99.46 -2.2% 72.02 -4.6% 27.44 4.9% 27.6 % 93.1 130.3 31 8/9 111.46 4.8% 78.38 4.2% 33.08 6.2% 29.7 % 283.2 136.9 30 8/2 100.58 -3.3% 73.19 -2.7% 27.40 -4.7% 27.2 % 187.2 125.4 29 7/26 99.91 8.7% 73.88 3.1% 26.03 28.5% 26.1 % 147.6 3.9 28 7/19 96.55 -5.0% 69.59 -8.5% 26.96 5.5% 27.9 % 133.9 159.9 27 7/12 80.04 -19.4% 60.76 -20.2% 19.28 -16.8% 24.1 % 14.6 124.3 Q2 HMM 1381.45 -1.7% 961.09 -5.7% 420.37 8.6% 30.4% 1833.8 1735.1 26 7/5 88.88 -11.2% 66.22 -15.0% 22.66 2.3% 25.5 % 4.6 1.1 25 6/28 96.64 -0.7% 67.38 -8.4% 29.26 23.1% 30.3 % 121.6 78.1 24 6/21 118.84 8.1% 76.92 -2.9% 41.93 36.6% 35.3 % 316.3 135.0 23 6/14 115.15 -21.0% 76.72 -21.8% 38.43 -19.4% 33.4 % 144.9 334.5 22 6/7 110.91 -9.8% 73.74 -15.1% 37.17 3.0% 33.5 % 243.4 325.5 21 5/31 82.78 -10.1% 60.65 -12.9% 22.12 -1.4% 26.7 % 23.6 18.4 20 5/24 89.23 -13.7% 63.85 -15.3% 25.38 -9.3% 28.4 % 189.1 84.8 19 5/17 84.90 -11.9% 62.00 -12.3% 22.89 -10.9% 27.0 % 72.1 61.8 18 5/10 91.35 -22.5% 67.02 -19.8% 24.33 -29.0% 26.6 % 5.7 223.5 17 5/3 88.49 -15.2% 64.85 -14.1% 23.65 -18.2% 26.7 % 51.6 189.7 16 4/26 89.68 -11.1% 65.32 -10.6% 24.37 -12.3% 27.2 % 0.1 113.5 15 4/19 176.28 56.2% 122.89 54.5% 53.39 60.3% 30.3 % 295.8 162.8 14 4/12 148.32 45.2% 93.53 23.4% 54.79 108.0% 36.9 % 365.0 6.4 Q1 HMM 1813.70 -11.6% 1223.93 -14.2% 589.76 -5.7% 32.5% 3164.4 3103.6 13 4/5 136.35 6.0% 90.67 -1.5% 45.68 24.8% 33.5 % 165.9 0.4 12 3/29 149.53 -32.9% 99.72 -35.3% 49.81 -27.6% 33.3 % 187.8 297.1 11 3/22 241.91 18.3% 139.92 11.3% 101.98 29.5% 42.2 % 641.1 618.9 10 3/15 145.68 -10.9% 101.76 -8.6% 43.92 -15.8% 30.1 % 66.6 247.4 9 3/8 165.48 -15.3% 106.21 -20.7% 59.26 -3.4% 35.8 % 488.3 257.6 8 3/1 155.39 -12.4% 98.31 -23.9% 57.09 18.3% 36.7 % 503.8 315.7 7 2/22 127.22 -19.7% 88.74 -16.0% 38.47 -27.0% 30.2 % 0.2 247.3 6 2/15 155.64 -20.7% 111.97 -15.2% 43.67 -31.9% 28.1 % 162.8 368.9 5 2/8 117.08 -18.4% 84.67 -18.6% 32.41 -17.9% 27.7 % 144.0 171.1 4 2/1 118.53 -4.5% 84.08 -5.7% 34.46 -1.4% 29.1% 318.9 221.4 3 1/25 96.17 -7.9% 69.76 -11.4% 26.41 2.7% 27.5% 195.3 47.0 2 1/18 106.11 -10.2% 76.19 -11.5% 29.92 -6.8% 28.2% 261.6 213.6 1 1/11 98.61 -14.2% 71.93 -15.1% 26.68 -11.8% 27.1% 28.2 97.3 2013 HMM 7539.31 -8.3% 5242.51 -13.1% 2296.82 4.9% 30.5% 10668.2 10071.3 Q4 HMM 2766.93 -9.8% 1851.78 -14.0% 915.15 0.1% 33.1% 3728.2 3249.2 53 1/4 126.71 -11.6% 89.22 -14.9% 37.49 -2.5% 29.6% 24.5 67.2 52 12/28 272.62 14.2% 187.84 9.7% 84.77 25.6% 31.1% 83.8 11.9 51 12/21 386.85 -8.2% 261.74 -14.4% 125.11 8.2% 32.3% 406.8 284.4 50 12/14 330.14 -5.5% 203.04 -15.2% 127.10 15.7% 38.5% 617.5 493.4 49 12/7 230.30 -24.6% 151.36 -22.3% 78.94 -28.7% 34.3% 235.1 586.2 48 11/30 372.25 70.3% 253.10 64.6% 119.15 83.8% 32.0% 79.9 133.4 47 11/23 156.10 -60.0% 105.57 -62.3% 50.53 -54.0% 32.4% 354.0 85.0 46 11/16 149.93 -12.3% 94.62 -18.5% 55.31 0.9% 36.9% 376.1 326.6 45 11/9 124.86 -3.7% 87.74 -6.2% 37.12 2.7% 29.7% 209.3 315.0 44 11/2 128.93 2.0% 87.22 -9.4% 41.72 38.1% 32.4% 301.9 93.5 43 10/26 108.04 -27.3% 78.18 -28.3% 29.87 -24.6% 27.6% 212.5 227.0 42 10/19 131.05 -5.6% 87.75 -11.0% 43.30 7.7% 33.0% 293.5 350.8 41 10/12 119.64 -13.2% 81.55 -11.3% 38.09 -16.9% 31.8% 244.6 181.9 40 10/5 129.51 -12.4% 82.85 -14.9% 46.65 -7.6% 36.0% 288.6 93.1 Q3 DEG 1448.64 -13.4% 1011.45 -15.4% 437.19 -8.3% 30.2% (EST)273.9 15.9%(share) Q3 HMM 1401.22 -14.3% 1010.62 -16.4% 390.58 -8.4% 27.9% 2017.4 2145.2 39 9/28 125.64 -37.1% 79.05 -29.2% 46.59 -47.1% 37.1% 414.8 624.7 38 9/21 113.74 -4.1% 78.15 -13.1% 35.58 24.2% 31.3% 213.5 116.7 37 9/14 132.99 -1.9% 85.34 -15.8% 47.65 39.1% 35.8% 239.8 211.1 36 9/7 108.70 8.9% 80.72 -13.8% 27.98 8.9% 25.7% 123.8 46.5 35 8/31 114.52 -21.0% 84.31 -21.6% 30.21 -19.3% 26.4% 197.5 262.5 34 8/24 102.07 -29.3% 76.50 -28.1% 25.57 -32.7% 25.1% 146.4 105.5 33 8/17 101.24 -31.8% 75.14 -30.9% 26.10 -34.2% 25.8% 130.3 412.4 32 8/10 106.13 -8.3% 75.01 -13.4% 31.12 7.0% 29.3% 136.9 216.2 31 8/3 103.89 10.4% 75.15 -1.7% 28.74 62.5% 27.7% 125.4 0.1 30 7/27 91.47 -3.5% 71.25 -4.9% 20.21 1.8% 22.1% 3.9 18.5 29 7/20 101.61 -3.4% 76.01 -7.2% 25.60 9.8% 25.2% 159.9 81.0 28 7/13 99.26 -5.7% 76.13 -8.7% 23.13 6.0% 23.3% 124.3 59.6 27 7/6 99.96 -8.0% 77.86 -9.5% 22.10 -2.4% 22.1% 1.1 0.5 Q2 DEG 1457.26 -13.0% 1052.97 -16.7% 404.29 -1.5% 27.7% (EST)259.4 15.1%(share) Q2 HMM 1432.97 -13.2% 1031.66 -17.1% 401.32 -1.3% 28.0% 1777.3 2318.0 26 6/29 97.21 -21.8% 73.46 -20.8% 23.76 -24.7% 24.4% 78.1 350.5 25 6/22 109.92 -5.8% 79.23 -10.9% 30.69 10.7% 27.9% 135.0 98.6 24 6/15 145.76 -10.6% 98.08 -15.6% 47.68 1.9% 32.7% 334.2 275.5 23 6/8 122.79 -19.0% 86.72 -18.2% 36.06 -21.0% 29.4% 325.2 374.1 22 6/1 91.91 -18.9% 69.55 -20.2% 22.36 -14.4% 24.3% 18.4 37.0 21 5/25 103.15 -6.7% 75.17 -10.1% 27.98 3.8% 27.1% 84.8 178.2 20 5/18 96.09 -12.1% 70.43 -15.0% 25.67 -3.1% 26.7% 61.8 200.1 19 5/11 117.72 -5.1% 83.48 -11.5% 34.24 15.4% 29.1% 223.5 187.5 18 5/4 104.34 -4.3% 75.45 -12.1% 28.89 24.7% 27.7% 189.5 105.0 17 4/27 100.75 -4.2% 72.97 -8.6% 27.78 9.8% 27.6% 157.3 67.9 16 4/20 112.75 1.5% 79.45 -3.3% 33.30 14.9% 29.5% 162.8 236.0 15 4/13 102.06 -6.0% 75.74 -12.1% 26.32 17.6% 25.8% 6.4 51.8 14 4/6 128.52 -36.9% 91.93 -41.8% 36.59 -20.0% 28.5% 0.4 155.8 Q1 DEG 2098.83 2.1% 1455.55 -6.7% 643.28 28.5% 30.6% (EST)231.2 9.9%(share) Q1 HMM 2064.90 2.5% 1437.67 -6.2% 627.26 30.1% 30.4% 3169.8 2426.1 13 3/30 222.64 41.9% 153.75 26.4% 68.89 95.1% 30.9% 294.8 171.2 12 3/23 204.22 35.8% 125.59 14.6% 78.63 92.8% 38.5% 618.7 356.9 11 3/16 163.59 10.3% 111.45 -1.8% 52.15 49.6% 31.9% 244.8 279.2 10 3/9 195.09 19.0% 133.76 10.1% 61.33 44.3% 31.4% 256.6 216.0 9 3/2 177.32 15.9% 129.10 10.1% 48.23 35.0% 27.2% 315.6 82.3 8 2/23 158.25 -1.7% 105.48 -14.7% 52.77 41.6% 33.3% 251.0 274.4 7 2/16 196.00 -6.2% 131.73 -18.6% 64.27 36.6% 32.8% 368.6 16.2 6 2/9 143.36 -30.4% 103.88 -31.5% 39.48 -27.5% 27.5% 171.1 321.4 5 2/2 124.02 -15.3% 89.11 -19.9% 34.91 -0.8% 28.1% 221.2 118.7 4 1/26 104.36 -19.8% 78.68 -18.6% 25.69 -23.2% 24.6% 46.5 226.0 3 1/19 118.15 -7.3% 88.02 -14.7% 32.13 20.7% 27.2% 213.2 114.0 2 1/12 114.83 -8.9% 84.56 -13.8% 30.27 8.1% 26.4% 96.8 116.2 1 1/5 143.07 5.5% 104.56 -0.1% 38.51 24.4% 26.9% 67.2 134.3

#5378

DVD Talk Special Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

UHD BD was up 70% last year, to $250 million (6.2% share of disc sales)

https://www.degonline.org/wp-content...Ent_Report.pdf

https://www.degonline.org/wp-content...Ent_Report.pdf

#5379

DVD Talk Limited Edition

#5380

Re: Blu-ray and DVD sales - We're number 2, but we try harder

Samsung has announced that they will stop making Blu-ray and UHD players for the US market,

https://www.cnet.com/news/samsung-to...s-report-says/

https://www.cnet.com/news/samsung-to...s-report-says/

#5381

DVD Talk God

Re: Blu-ray and DVD sales - We're number 2, but we try harder

4K UHD disc sales apparently had a good Q3 last year.

https://www.mediaplaynews.com/samsun...er-production/

https://www.mediaplaynews.com/samsun...er-production/

Regardless, home entertainment studios remain bullish on 4K UHD.

Format sales surged nearly 70% in the third quarter last year, according to DEG: The Digital Entertainment Group. There were 392 4K Ultra HD Blu-ray Disc titles available in Q3 representing more than $162 million in consumer spend for the period, and 595 4K titles available digitally.

“4K UHD discs already account for almost one in 10 new release discs sold in the U.S,” Eddie Cunningham, president of Universal Pictures Home Entertainment, told Media Play News.

Paramount Home Media Distribution boss Bob Buchi in January said the studio would offer most of its theatrical releases on 4K UHD Blu-ray, as well as select catalog titles.

“The response to our catalog 4K releases has been very promising, so we expect to see increased interest in owning treasured classics in the very best format available,” he said.

Format sales surged nearly 70% in the third quarter last year, according to DEG: The Digital Entertainment Group. There were 392 4K Ultra HD Blu-ray Disc titles available in Q3 representing more than $162 million in consumer spend for the period, and 595 4K titles available digitally.

“4K UHD discs already account for almost one in 10 new release discs sold in the U.S,” Eddie Cunningham, president of Universal Pictures Home Entertainment, told Media Play News.

Paramount Home Media Distribution boss Bob Buchi in January said the studio would offer most of its theatrical releases on 4K UHD Blu-ray, as well as select catalog titles.

“The response to our catalog 4K releases has been very promising, so we expect to see increased interest in owning treasured classics in the very best format available,” he said.

#5382

Re: Blu-ray and DVD sales - We're number 2, but we try harder

The 2018 numbers for the US music industry are out. As usual, apply lessons to the movie industry as you see fit.

Digital streaming is now 75% of the industry and still growing quite a bit.

Idle Thoughts:

- Vinyl and CD revenues are set to be very close in 2019.

- It won't be long now until Apple shuts down the iTunes Music Store if digital download sales continue declining at their current rate.

- Ditto for CD availability at WalMart and Target.

- CD sales are now lower than they were in 1986. That year CD sales grew 139% from $389.50 million in 1985 to $930.10 million.

- Vinyl sales growth is trending down a bit. It grew 9% in 2017, 8% in 2018. Sales are now about $100M less than they were in in 1988.

- CD revenue is down 33.9%. From $1.057 billion in 2017 to $698.4 million in 2018.

- Vinyl revenue is up 7.9%. From $388.5 million in 2017 to $419.2 million in 2018.

- Digital Download revenue is down 26.0%. From $1.404 billion in 2017 to $1.039 billion in 2018.

- Digital Streaming revenue is up 30.1%. From $5.664 billion in 2017 to $7.366 billion in 2018.

Idle Thoughts:

- Vinyl and CD revenues are set to be very close in 2019.

- It won't be long now until Apple shuts down the iTunes Music Store if digital download sales continue declining at their current rate.

- Ditto for CD availability at WalMart and Target.

- CD sales are now lower than they were in 1986. That year CD sales grew 139% from $389.50 million in 1985 to $930.10 million.

- Vinyl sales growth is trending down a bit. It grew 9% in 2017, 8% in 2018. Sales are now about $100M less than they were in in 1988.

Last edited by WeeBey; 03-05-19 at 06:03 AM.

#5383

DVD Talk Platinum Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

As someone that stills likes to buy CDs this does not sound good

#5384

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I knew it was a bad sign for CDs when my new Honda didn't even include a CD player. Which actually sucked for me because I still have a couple binders of CDs, that are now sitting in my basement.

#5385

DVD Talk Legend

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I'm assuming your new car at least came with the ability to play MP3s? Isn't it just more convenient to play MP3s in your car instead of having to store a bunch of CDs and keep changing them in the middle of drives (especially long drives)?

#5386

Re: Blu-ray and DVD sales - We're number 2, but we try harder

It has a touch screen with all of the different apps (apple whatever, Android auto, Spotify, bluetooth, etc), but yeah, no disc.

I'm sure it was a cost factor at the end of the day. Hell, I wouldn't be surprised if someone told me it was cheaper to make a touch screen now than a disc drive.

I'm sure it was a cost factor at the end of the day. Hell, I wouldn't be surprised if someone told me it was cheaper to make a touch screen now than a disc drive.

#5387

Re: Blu-ray and DVD sales - We're number 2, but we try harder

It's far more convenient, and safer, to just plug in a different CD than taking your eyes off the road to scroll through dozens, if not hundreds, of titles looking for the album you want to hear.

#5388

DVD Talk Ultimate Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

My car stereo can also play *.wav files from a flash drive. Though it doesn't mention this in the paper owner's manual.

(Officially it only mentions mp3 files can be played on the car stereo).

(Officially it only mentions mp3 files can be played on the car stereo).

#5389

DVD Talk Hall of Fame

Re: Blu-ray and DVD sales - We're number 2, but we try harder

If I feel like listening to a particular cd in it's entirety, I play the cd.

I have my entire collection ripped to several flash drives based on genre and era. My only interest in flash drives is random play. It's my radio now. Each drive is a separate commercial free channel.

I do not rip live music. I play cd from beginning to end.

I do not rip songs that run together. I listen to the cd.

I have my entire collection ripped to several flash drives based on genre and era. My only interest in flash drives is random play. It's my radio now. Each drive is a separate commercial free channel.

I do not rip live music. I play cd from beginning to end.

I do not rip songs that run together. I listen to the cd.

#5391

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I think they only mention MP3 because the average person likely has no idea what a FLAC or WAV file is. You avoid confusion and questions that way. I know when I asked at the dealership if it'd play FLAC files I got a "Don't know. What is that?" reply. They also couldn't tell me if there was a CD option. I had to contact the manufacturer who referred me back to the dealer. I knew the model up offered a CD option and just wanted to know if it could be installed in my model. Clueless...

#5392

DVD Talk Hero

Re: Blu-ray and DVD sales - We're number 2, but we try harder

You aren't alone, I still heavily purchase CDs and remain committed to the format. There's a big enough base of long-time users that CD will hang around for years, much like vinyl during the 1990s when the music labels all but tried killing it off.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

#5393

DVD Talk Hero

Re: Blu-ray and DVD sales - We're number 2, but we try harder

Yeah, I think half the issue of falling CD sales is due to stores not carrying them. Sure, they stopped carrying them due to lowered sales, but their actions just accelerate it's decline even more.

As for listening in my car, I sill have a couple iPods full of my music (that I really need to update with new stuff I've bought), and they play/sound great through my car's USB port.

As for listening in my car, I sill have a couple iPods full of my music (that I really need to update with new stuff I've bought), and they play/sound great through my car's USB port.

#5394

DVD Talk God

Re: Blu-ray and DVD sales - We're number 2, but we try harder

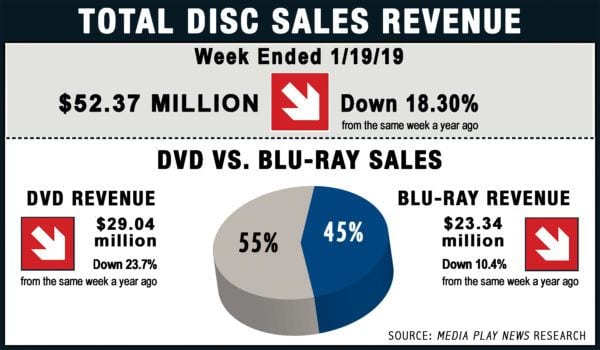

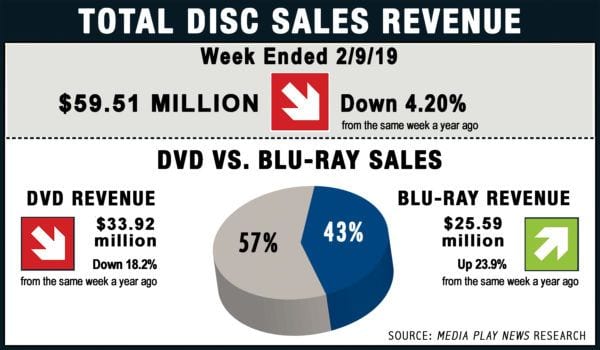

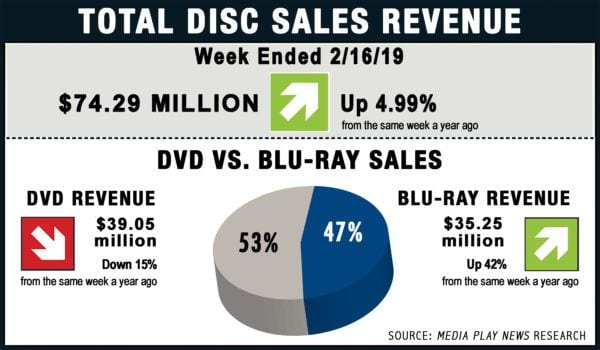

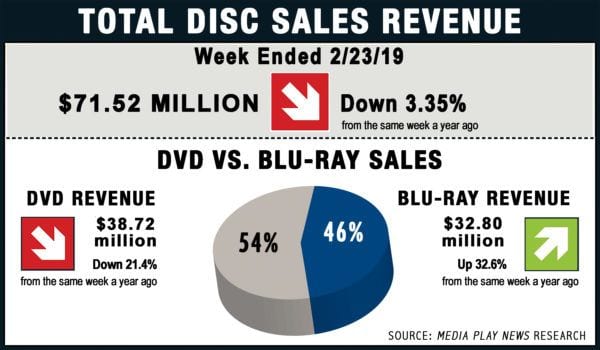

I wonder what helped spike Blu-Ray sales in February?

Most notable titles were Bohemian Rhapsody and A Star is Born. I guess with the Academy buzz it helped spike interest in people wanting to own them.

Most notable titles were Bohemian Rhapsody and A Star is Born. I guess with the Academy buzz it helped spike interest in people wanting to own them.

#5395

DVD Talk Reviewer & TOAT Winner

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I used to buy a ton of CDs every month (this was before DVDs, and even before I was buying laserdiscs), main reason I stopped was because the prices kept going up. They seem to have settled a bit, and I've seen some decent ones (catalog titles and greatest hits) for about $5, but I just don't get as much of a thrill from them as I did back then. I'd much rather buy a music DVD or Blu-Ray that also includes a visual element and usually a multi-channel sound mix. The industry could still do SOMETHING to get CD sales back up again if they really wanted to.

#5396

DVD Talk Platinum Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

You aren't alone, I still heavily purchase CDs and remain committed to the format. There's a big enough base of long-time users that CD will hang around for years, much like vinyl during the 1990s when the music labels all but tried killing it off.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

I was looking around and came across this article, CD Sales Are Not Dying, But They Are Heading Towards Niche Status Like Vinyl: Analysis, What I found especially interesting is that there's apparently a bunch of albums on the Billboard charts that don't even have CD versions.

#5397

DVD Talk Legend

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I was looking around and came across this article, CD Sales Are Not Dying, But They Are Heading Towards Niche Status Like Vinyl: Analysis, What I found especially interesting is that there's apparently a bunch of albums on the Billboard charts that don't even have CD versions.

#5398

Senior Member

Join Date: Nov 2009

Location: Connecticut

Posts: 323

Likes: 0

Received 0 Likes

on

0 Posts

Re: Blu-ray and DVD sales - We're number 2, but we try harder

You aren't alone, I still heavily purchase CDs and remain committed to the format. There's a big enough base of long-time users that CD will hang around for years, much like vinyl during the 1990s when the music labels all but tried killing it off.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

Just prepare to order everything from the internet, because retail likely will dump CD completely within the next year. Select Barnes & Nobles locations seem committed to carrying a decent-sized CD area.

My Target for the most part has the endcap with new releases, and one tiny section, half of which is dedicated to budget ($5 - $7) catalogue greatest hits titles that have been out forever and the other half dedicated to somewhat recent releases. You'd be hard pressed to find even a mainstream title that's been out longer than 6 - 12 months. Walmart's slightly better, not by much, and even their $5 bin - which used to be somewhat impressive - has seen a massive dip in quality and quantity. My Barnes & Noble also got rid of most of their once massive CD section.

#5399

DVD Talk Ultimate Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder

I still buy a lot of cds, though largely out of inertia and laziness.

There's two large categories I still buy.

My primary one is re-releases and/or compilations of old unreleased demo tapes + heydays live shows of bands I use to listen to back in the day.

The second category is somewhat more sordid and has very little to do with listening to music. In recent times, I've been going through thift shops and searching for early->mid 2000s era cd titles which had extra basketcase drm, such as EMI titles with Cactus Data Shield (CDS200 or 300) , Sony/BMG stuff with the nasty rootkit stuff (Mediamaxx and XCP), etc ... Mostly examining the underlying technical details of how the extra drm functioned.

Most of these drm infested basketcase cds were dropped and/or recalled back in late 2005. So they're almost extinct as brand new factory sealed copies. Nowadays the only places to really find such basketcae cd discs, are in the $1/$2 (or less) bins at thift shops or the few remaining second handed record stores.

There's two large categories I still buy.

My primary one is re-releases and/or compilations of old unreleased demo tapes + heydays live shows of bands I use to listen to back in the day.

The second category is somewhat more sordid and has very little to do with listening to music. In recent times, I've been going through thift shops and searching for early->mid 2000s era cd titles which had extra basketcase drm, such as EMI titles with Cactus Data Shield (CDS200 or 300) , Sony/BMG stuff with the nasty rootkit stuff (Mediamaxx and XCP), etc ... Mostly examining the underlying technical details of how the extra drm functioned.

Most of these drm infested basketcase cds were dropped and/or recalled back in late 2005. So they're almost extinct as brand new factory sealed copies. Nowadays the only places to really find such basketcae cd discs, are in the $1/$2 (or less) bins at thift shops or the few remaining second handed record stores.

#5400

DVD Talk Ultimate Edition

Re: Blu-ray and DVD sales - We're number 2, but we try harder